EU cleantech investment lags behind the US and China

The European Union (EU) is facing a significant challenge in meeting its ambitious energy transition targets for 2030. According to research and modeling by Rystad Energy, the bloc's investments in clean technologies are falling far behind those of the United States and China. Despite the EU’s lofty goals, the reality of clean tech investment paints a less optimistic picture.

Investment disparities: EU vs. US and China

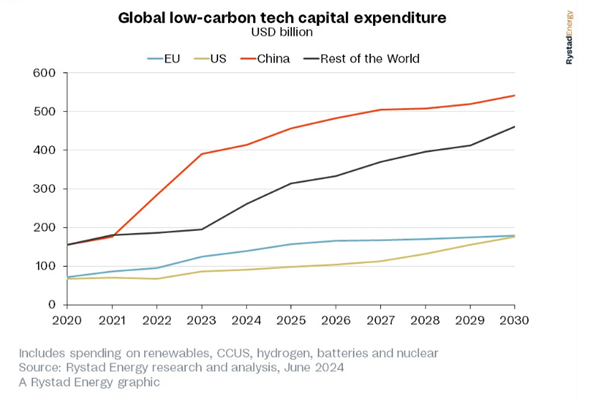

Rystad Energy's analysis reveals a stark contrast in clean tech capital expenditures (capex) between the EU, China, and the US. In 2023, the EU's investments in renewables, carbon capture, utilization and storage (CCUS), hydrogen, batteries, and nuclear totalled $125 billion. This figure was dwarfed by the $390 billion invested by China in the same sectors. Although the US lagged behind the EU in 2023 with $86 billion in clean tech spending, the Inflation Reduction Act is expected to catalyze significant growth, positioning the US to match and eventually surpass the EU by 2030.

The Net-Zero Industry Act (NZIA) and its challenges

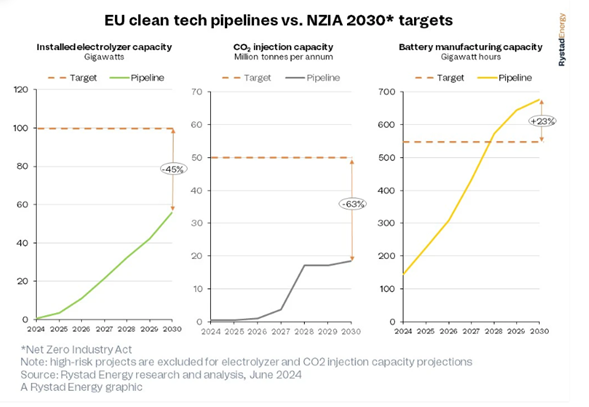

The EU's Net-Zero Industry Act (NZIA), passed earlier this year, aims to cut emissions by 92% from 1990 levels by 2040 and achieve net zero by 2050. The Act sets ambitious targets for the production and deployment of key clean technologies, including batteries, CCUS, and hydrogen electrolyzers. However, Rystad Energy points out that these ambitions are not aligning with reality. For instance, the battery sector shows promise, yet many European manufacturers are relocating to the US to benefit from better incentives. Examples include FREYR Battery moving its headquarters to the US and Volkswagen exploring opportunities in Canada.

Source: Rystad Energy

Source: Rystad Energy

Political shifts and their implications

The upcoming EU elections could significantly impact the bloc's climate policies. Rystad Energy warns that a shift to the right, as seen in recent national elections, might increase Euroscepticism and reduce the commitment to climate change initiatives. Lars Nitter Havro, Senior Energy Systems Analyst at Rystad Energy, emphasizes that the stakes are high: "The EU strives to remain competitive in the global clean tech market, but a rising right-wing populist wave could critically heighten the risk of falling further behind the US and China."

Sector-specific struggles: CCUS and hydrogen

Rystad Energy's report highlights specific challenges within the CCUS and hydrogen sectors. The development of injection and storage infrastructure for CCUS is lagging, with the projected CO2 injection capacity expected to fall short of NZIA targets by 63% by 2030. Similarly, hydrogen electrolyzers are not meeting the NZIA’s goals. Despite policy support, the risked pipeline for hydrogen electrolyzers is falling 45% short of the target, underscoring the difficulties in scaling up hydrogen production. This shortfall can be attributed to a variety of factors, including technological challenges, high initial costs, and the slow development of the necessary infrastructure to support a widespread hydrogen economy.

Source: Rystad Energy

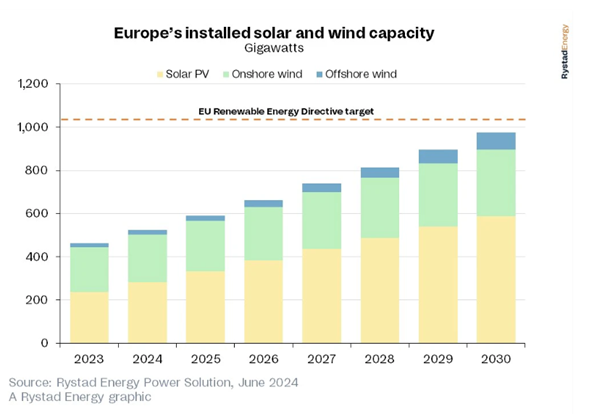

Renewable energy directive and manufacturing base concerns

The EU's updated Renewable Energy Directive (RED III) sets a goal of generating 42.5% of its power from renewable sources by 2030. Although the bloc is close to this target with an expected 975 gigawatts (GW) of combined solar and wind capacity, it still falls short of the required 1,050 GW. The success of this directive depends heavily on continued political and financial support, which is threatened by potential political shifts and the migration of key industry players to more favourable markets like the US.

Source: Rystad Energy

Source: Rystad Energy

A critical juncture for the EU

As the EU navigates these challenges, the need for competitive developer conditions and cohesive political support becomes increasingly evident. Rystad Energy’s findings indicate that without significant changes, the EU is unlikely to achieve its 2030 net-zero targets. The next few years are crucial for the bloc to close the gap and maintain its position in the global clean tech market.

Comentarios

Sé el primero en comentar...